The Of Clark Wealth Partners

Wiki Article

The Clark Wealth Partners Diaries

Table of ContentsThe 15-Second Trick For Clark Wealth PartnersEverything about Clark Wealth PartnersFascination About Clark Wealth PartnersAll about Clark Wealth PartnersClark Wealth Partners Things To Know Before You BuyWhat Does Clark Wealth Partners Mean?Getting The Clark Wealth Partners To WorkThe Only Guide to Clark Wealth Partners

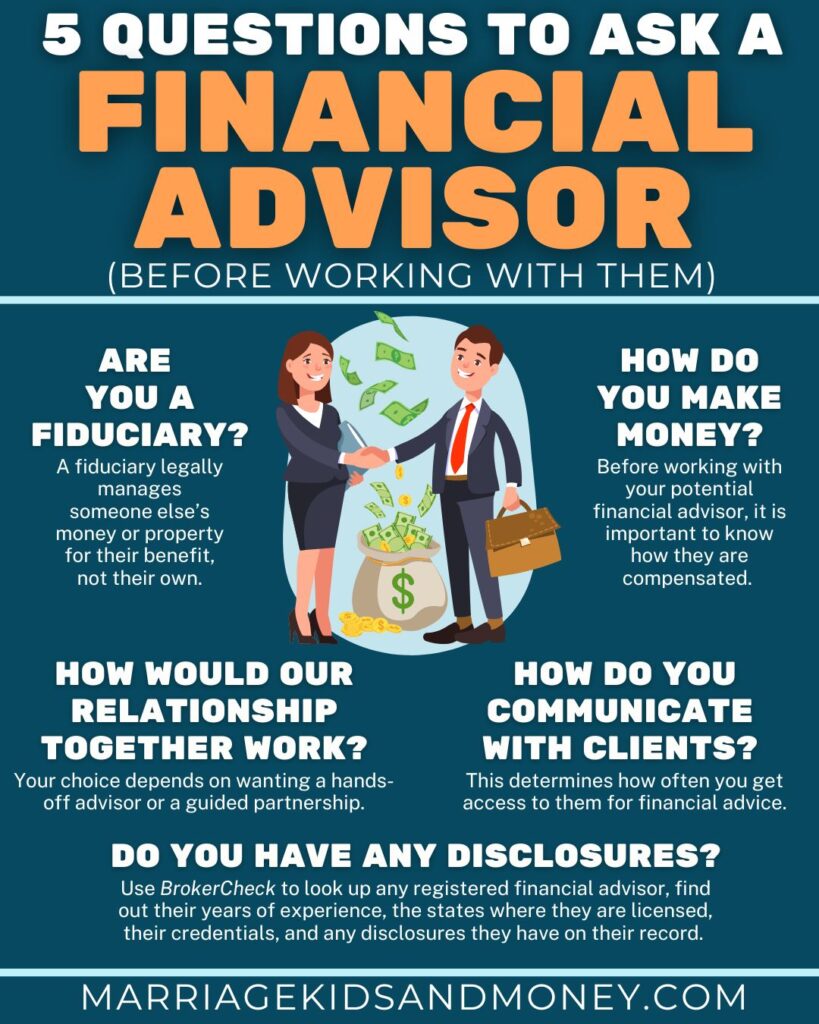

Usual reasons to think about a financial expert are: If your monetary scenario has come to be much more intricate, or you do not have self-confidence in your money-managing skills. Conserving or navigating major life occasions like marriage, separation, children, inheritance, or job adjustment that may considerably influence your monetary scenario. Browsing the change from saving for retirement to preserving wide range throughout retirement and just how to develop a strong retirement revenue plan.New technology has actually led to more thorough automated financial tools, like robo-advisors. It depends on you to investigate and establish the appropriate fit - https://www.bark.com/en/us/company/clark-wealth-partners/KNA896/. Ultimately, an excellent monetary expert must be as mindful of your financial investments as they are with their own, avoiding extreme fees, saving cash on taxes, and being as clear as feasible regarding your gains and losses

Rumored Buzz on Clark Wealth Partners

Gaining a payment on product recommendations doesn't necessarily imply your fee-based consultant functions against your benefits. They may be much more inclined to recommend products and services on which they make a compensation, which might or might not be in your ideal interest. A fiduciary is lawfully bound to put their client's interests first.This typical permits them to make referrals for investments and services as long as they match their client's goals, threat tolerance, and economic scenario. On the other hand, fiduciary consultants are lawfully bound to act in their client's ideal rate of interest instead than their own.

Clark Wealth Partners Can Be Fun For Anyone

ExperienceTessa reported on all things spending deep-diving right into complicated financial topics, clarifying lesser-known investment opportunities, and revealing ways visitors can work the system to their benefit. As a personal finance specialist in her 20s, Tessa is acutely mindful of the effects time and unpredictability carry your financial investment choices.

It was a targeted advertisement, and it functioned. Learn more Review less.

An Unbiased View of Clark Wealth Partners

site here There's no solitary course to ending up being one, with some people beginning in financial or insurance coverage, while others start in audit. A four-year level offers a strong foundation for careers in investments, budgeting, and customer services.

Clark Wealth Partners for Beginners

Usual examples consist of the FINRA Collection 7 and Collection 65 exams for securities, or a state-issued insurance policy permit for marketing life or wellness insurance coverage. While qualifications might not be legally needed for all intending duties, companies and clients frequently watch them as a criteria of professionalism and reliability. We consider optional credentials in the next area.Many economic coordinators have 1-3 years of experience and knowledge with financial items, conformity standards, and direct customer interaction. A solid educational background is necessary, but experience shows the ability to use theory in real-world setups. Some programs incorporate both, enabling you to finish coursework while gaining monitored hours with teaching fellowships and practicums.

What Does Clark Wealth Partners Mean?

Very early years can bring lengthy hours, pressure to develop a client base, and the requirement to constantly prove your experience. Financial planners appreciate the opportunity to work very closely with customers, guide vital life decisions, and commonly achieve versatility in timetables or self-employment.

Wealth managers can increase their profits via payments, property fees, and performance incentives. Financial managers supervise a team of financial coordinators and advisors, setting departmental approach, taking care of compliance, budgeting, and routing interior operations. They spent much less time on the client-facing side of the sector. Virtually all monetary supervisors hold a bachelor's level, and lots of have an MBA or comparable academic degree.

Our Clark Wealth Partners Ideas

Optional qualifications, such as the CFP, commonly require extra coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Data, individual monetary experts gain an average annual annual wage of $102,140, with top income earners making over $239,000.In various other districts, there are regulations that require them to fulfill certain needs to use the economic consultant or economic planner titles (retirement planning scott afb il). What establishes some financial consultants besides others are education and learning, training, experience and qualifications. There are several designations for monetary advisors. For financial planners, there are 3 common designations: Licensed, Personal and Registered Financial Planner.

Clark Wealth Partners for Dummies

Where to locate a financial expert will certainly depend on the type of recommendations you need. These organizations have personnel who might aid you recognize and get specific types of financial investments.Report this wiki page